Thanks to the generous support of the School of Business, we are happy to announce campus-wide access to PitchBook during an initial one year-trial of this powerful and comprehensive venture capital (VC), private equity (PE), and mergers and acquisition (M&A) database. *When you log in you will be asked to enter your Wake Forest email.

So what all can PitchBook help you do when it comes to researching VC, PE, and M&A? Well, log in to see detailed information on companies, deals, investors, funds and professionals within the industry.

Before we go into specifics on how to get started, just know that PitchBook has a plethora of resources available to you about their platform all easily accessible via their ‘help center’ tab to the right of their main search bar. Within their help center you’ll find live training and on-demand course offerings that can teach you a variety of ways to utilize PitchBook for your needs.

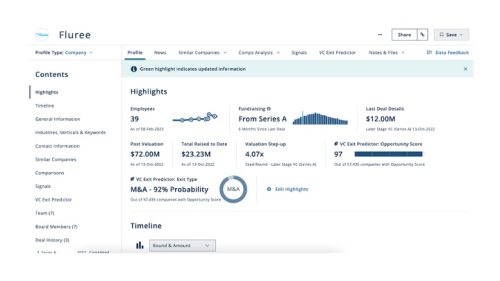

We foresee PitchBook’s private company data being some of the most useful and utilized aspects of this database, though they also have outstanding public company data as well. Luckily, adding PitchBook to our repertoire of resources has helped fill the gap that previously existed for us regarding private company data. That being said, you can use the main search bar to search by company name.

![]()

From there, select the company and press the button to ‘go to their full profile’. Their full profile will contain company highlights, industry verticals, similar companies, competitors, company executive details and contact information, their deal history (who has invested and for how much) and MORE!

Of course, if you don’t have a particular company in mind, you can always use the ‘Companies & Deals’ screener to see pre-compiled lists of companies, such as unicorn companies, recent exits or IPOs, M&A’s and more.

The screeners are a great way to get started using and exploring PitchBook is to select one of the predetermined screeners from the left hand navigation menu and continue to ‘fall down the rabbit hole’ as it relates to your interests.

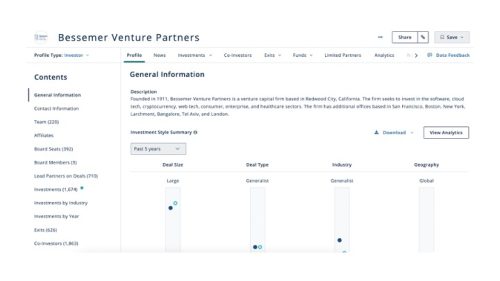

The other major use case we see for PitchBook is searching for funds! Whether it’s for a finance project, a job interview or you’re looking for funding for your startup – PitchBook is a great place for this! You can select the ‘Investors & Funds’ screener option to get started. With this screener option PitchBook has made it as easy as one click to see funds with dry powder, funds that are currently fundraising, top seed investors, funds interested in invested in women and minority-owned businesses and more. Once you click any of these sub-screener options, you can customize your search with further filters such as location, deal type, deal size, industry and more or just press ‘search’ if you don’t want to add further customizations – either way PitchBook will generate you an epic list of funds to check out.

When looking at the list of funds generated by PitchBook, you’ll see information about their recent investments, how many investments are active in their portfolio, how many investments they’ve made in the last 6 months-2 years, and more. You can click on individual fund names to enter their full profile. In their profile, you’ll see even more details like whether they’re a generalist or specialist, who else they invest with, their contact information, who their limited partners are and more!

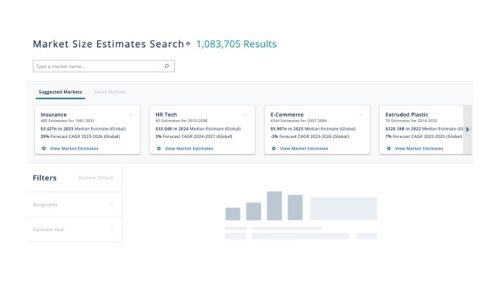

Last but definitely not least, are the industry and market research reports that PitchBook produces that are accessible under the ‘Library’ and ‘Market Analysis’ options on the left navigation menu. PitchBook’s Library Research Center covers topics, unsurprisingly similar to the data that they offer, including topics such as private equity, public equity, emerging technologies, etc. While their Market Analysis covers verticals such as AI, Clean Energy, Crypto, Fintech, Insurtech, and more (think emerging technologies). Excitingly enough, many of these market analyses include an estimate of the market size! We know from working with many students how challenging this estimate can be to find and/or determine for emerging markets, so to say we’re excited about this source is an understatement!

Give PitchBook a try today, I’m sure you’ll be surprised with what you find and the sheer amount of detail available. If you’d like to talk more about how we can help you introduce PitchBook to your class, how PitchBook might help you with a project or your own research, please get in touch. We’re happy to talk more about data download limits, tools within PitchBook to help make your research process easier (i.e. workspaces, lists, plug-ins), and even to discuss how to work directly with PitchBook for particular research requests.

3 Comments on ‘New Resource Alert! Introducing…PitchBook!’

Thanks for the overview! This sounds like an amazing addition to our research portfolio. It makes me wish I had an idea for a startup!

Thank you for the detailed overview Summer and Morgan!

A very cool tool! You are so right, it’s easy to fall down the rabbit hole!